Why Institutional Indexing for Affluent Investors?

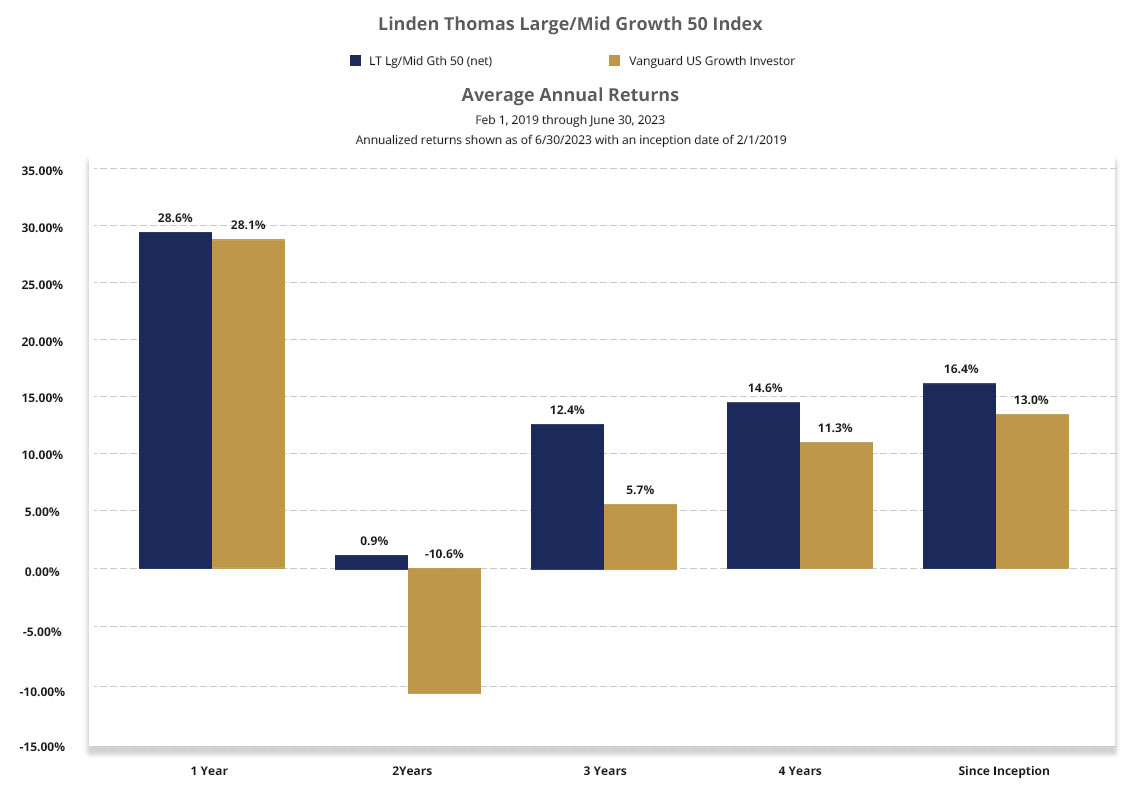

2021 LTC Top Index Results

Why Institutional Indexing for Our Affluent Investors?

Since the 1970s when the first index fund was created, both small and large investors have flocked to pooled index funds because of the ease and popularity.

When asked why, many would say it is due to the perceived low cost or the failure of the retail investment advisor’s ability to add value.

While pooled index funds may be a viable option for small investors, affluent investors with over $1 million qualify for institutional investing. The Linden Thomas & Company’s institutional earnings focused index gives investors enhanced results through three key academic disciplines. These three focuses are earnings quality, direct ownership of holdings, and minimizing cost. Our earnings focus helps avoid failing companies often found in market-cap index funds. Through direct equity ownership, it means our investors avoid herding impact often found in pooled funds due to small investor's poor behaviors. Hidden trading costs and high advisor costs are avoided as well. Linden Thomas & Company provides affluent investors with enhanced long-term results through high quality securities, total control, and transparency all with less of a cost.

Each of the Linden Thomas & Company portfolios give clients access to our earnings-focus institutional indexing as well as some of the industry's top institutional equity managers. Our yield-focus fixed-income portfolios are built from the ground up and tailored around each clients' needs. The benefit of our approach is clients gain a team of professionals with decades of industry experience and proven results.

How We Compare with Cumulative Results

Retail investment products often carry hidden costs and other disadvantages which impact investor results. Institutional Direct alleviates the need to pay high advisor fees and invest in products like mutual funds. This helps reduce investor costs by hiring the asset manager directly, which takes away hidden fees and pricing disadvantages of pooled investment products. Linden Thomas & Company has developed an interactive tool to help illustrate Institutional Indexing vs. a variety of retail mutual funds.

The performance results shown are those of a proprietary account at Linden Thomas invested using real dollars based upon the application of Linden Thomas's Proprietary Linden Thomas Large/Mid Growth 50 Index. These performance results are presented net of a .85% advisory fee. The performance results do not reflect the deduction of other fees or expenses, including but not limited to brokerage fees, custodial fees, fees and expenses charged by mutual funds and other investment companies, and any other fee or expenses a client may incur in the management of such client's investment advisory account. A client's return with respect to an investment would be reduced by any fees or expenses a client may incur in the management of its investment advisory account. The performance results are unaudited and are not an estimate of any specific investors actual performance, which may be materially different from such performance depending on numerous factors. No representations or warranties whatsoever are made by Linden Thomas or any other person or entity as to the future profitability of an investment account or the results of making an investment. Past performance is not a guarantee of future results.

Flaws of Retail Mutual Funds

As the retail investment firms have grown, there has been a push by the retail investment advisor to place investors in pooled index funds. This is often associated with investors paying an advisor fee along with additional hidden costs of mutual funds. Many of the index funds want investors to believe these funds are benefiting the client due to the low expense ratios, but what is never discussed is the hidden costs and inefficiencies which impact results.

-

- Trading costs

- Spreads on trades

- High advisor cost

- Small investor herding impact

- Phantom taxes

- Pricing disadvantages

All these items (while seldom discussed) can be found in not only index funds but other retail investment products as well. This is why Linden Thomas & Company set out to develop an institutional approach with a focus on client results through building efficient portfolios and our institutional indexes.

Affluent Investor - Investment Questionnaire

We believe great results are no accident!Thank you for showing interest in Linden Thomas & Company. Your time is valuable to us, by providing answers to these few questions below, we can properly assess your needs and put you on the right track to success! *Denotes required field

Celebrating 30 YEARS of Putting Clients first, because...

CLIENT SUCCESS MATTERS.

National

Recognitions

Years Putting

Clients First

Valued

Clients

32 National Recognitions and Counting...

LEGAL DISCLAIMERS: Securities services offered through Linden Thomas & Company Securities, LLC; member FINRA/SIPC. Advisory services offered through Linden Thomas Advisory Services, LLC. Linden Thomas & Company Securities, LLC and Linden Thomas Advisory Services, LLC are affiliated entities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. An investor should carefully read and review all information provided by Linden Thomas Advisory Services, LLC ("Linden Thomas & Company"), including, the Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

The information contained herein reflects the opinions and projections of Linden Thomas & Company as of the date of publication, which are subject to change without notice at any time subsequent to the date of issue. Linden Thomas & Company does not represent that any opinion or projection will be realized. All information provided is for informational purposes only and should not be deemed as investment advice or a recommendation to purchase or sell any specific security. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any data presented. Prospective clients should not treat these materials as advice in relation to legal, taxation, or investment matters. For further information on the criteria or methodology of awards earned, or the relevant articles and publications in which they appear, please contact your Representative. Linden Thomas does not directly or indirectly compensate third-party rating agencies to be considered for awards.

Statements herein that reflect projections or expectations of future financial or economic performance of investments, including investments in Linden Thomas & Company Indexes (each an 'index'), are forward-looking statements. Such 'forward-looking' statements are based on various assumptions, which assumptions may not prove to be correct. Accordingly, there can be no assurance that such assumptions and statements will accurately predict future events or an index's actual performance. No representation or warranty can be given that the estimates, opinions, or assumptions made herein will prove to be accurate. Any projections and forward-looking statements included herein should be considered speculative and are qualified in their entirely by the information and risks disclosed in the Form ADV, Part 2A brochure. Actual results for any period may or may not approximate such forward-looking statements. Prospective investors are advised to consult with their own independent tax and business advisors concerning the validity and reasonableness of the factual, accounting and tax assumptions. No representations or warranties whatsoever are made by Linden Thomas & Company or any other person or entity as to the future profitability of the index or the results of making an investment based on the index. Past performance is not a guarantee of future results.

The performance results shown are those of a proprietary account at Linden Thomas invested using real dollars based upon the application of Linden Thomas's Proprietary Linden Thomas Large/Mid Growth 50 Index. These performance results are presented net of a .85% advisory fee. The performance results do not reflect the deduction of other fees or expenses, including but not limited to brokerage fees, custodial fees, fees and expenses charged by mutual funds and other investment companies, and any other fee or expenses a client may incur in the management of such client's investment advisory account. A client's return with respect to an investment would be reduced by any fees or expenses a client may incur in the management of its investment advisory account. The performance results are unaudited and are not an estimate of any specific investors actual performance, which may be materially different from such performance depending on numerous factors. No representations or warranties whatsoever are made by Linden Thomas or any other person or entity as to the future profitability of an investment account or the results of making an investment. Past performance is not a guarantee of future results.

Various indices, including, but not limited to the S&P 500 Index and the Russell 2000 Index (each a "Third-party Index") are unmanaged indices of securities that are used as a general measure of market performance, and their performance is not reflective of the performance of any specific investment. The Vanguard 500 benchmark index measures the investment return of large-capitalization stocks. The Third-party Index comparisons are provided for informational purposes only and should not be used as the basis for making an investment decision. Further, the performance of the Index and each Third-party Index may not be comparable. There may be significant differences between the Index and each Third- party Index, including, but not limited to, risk profile, liquidity, volatility and asset comparison. The performance shown for each Third-party Index reflects no deduction for client withdrawals, fees or expenses. Accordingly, comparisons between the Index and each Third-party Index may be of limited use. Investments cannot be made directly into the Index or any Third-party Index.